Team Viz

Jul 03, 2024

In a time of tighter drug prices, extreme competition, and empowered patients, one thing has become clear for biopharma organizations: This is not your grandmother’s commercial market.

Decades ago, a sizeable field force played a sizeable role in biopharma commercial strategy, with sales reps being a first line into prescriber education, influence, and decision-making. But now that healthcare is changing, marketers’ gameplans are too—with less emphasis on in-person interactions and more on sophisticated technologies including artificial intelligence (AI).

Recently, McKinsey explored these topics in an article that highlighted the many ways biopharma commercial markets are transforming across dimensions of price pressure, payer dynamics, patient behaviors, and more—as well as the many ways their commercial strategies should adapt in response.

That piece—with all its language about “rethinking,” “reimagining,” and “redesigning”—caught our eye, not only because of its nod to AI but also for its central premise: Old, outdated roadmaps do no favors for marketers in desperate modern moments. Current challenges of operational complexities, revenue concerns, policy changes, and other forces demand a new model.

Why Biopharma Commercial Strategy Looks Different

Stakeholders have fretted over pharma’s impending inflection point for a while now, but a combination of factors has come together for an ultimate reality check, now more than ever.

Competition is a top concern—with certain markets like oncology seeing unprecedented challenges. In its analysis, McKinsey notes that in 2022, roughly nine brands vied for each oncology segment, on average, a surge from just two in 2000.

These trends come as lawmakers aim to improve competition through policy-driven pricing. Discounts and similar programs are up in the United States, but price pressure also extends to the Asia-Pacific, Europe, and beyond.

Meanwhile, patient behaviors look different as well. People feel empowered to research, assess, and own their patient journeys, and they want diverse information in diverse formats. Prescribers do too as they seek dynamic support that in-person sales can’t always give. These expectation shifts are just one reason sales reps have had a limited impact. Another is that hospitals have reduced reps’ access to doctors—a trend that occurred pre-pandemic but increased in 2020. Even now, many of those policies remain, forcing sales reps to digitize their interactions.

With these trends, McKinsey’s take is that innovation and access may be pharma’s golden key, not reps. With the traditional playbook staked on sales relationships unraveling, brands need to reconsider and reinforce their commercial strategies to be more efficient, effective, and patient-centric.

What and Where to Pivot: AI for Biopharma Marketing

Investing in new tech such as AI won’t wholly fix pharma’s problems, but many companies wager it’ll help. McKinsey notes the estimated future value of AI use cases—up to $100 billion—but early returns are already here: 40% of pharma leaders say they’re expecting savings from AI in 2024.

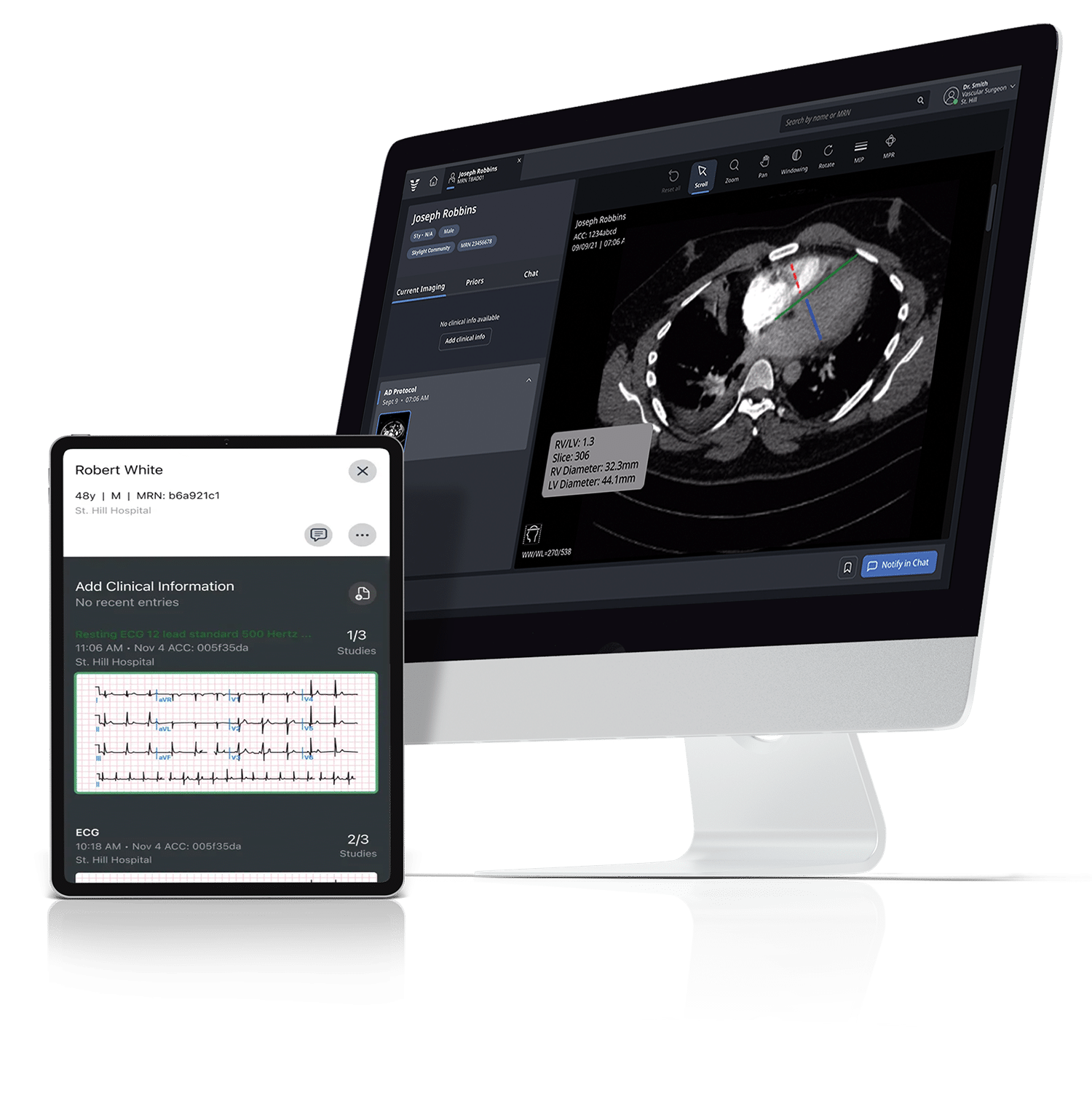

The benefits don’t stop at financial returns. In addition to other platforms that improve clinician or patient experiences (like predictive “next best action” tools), technologies like Viz.ai’s support cost reductions plus care outcomes and scalability that serve more patients more equitably.

These tech-enabled enhancements give insight into patient journey gaps, an advantage Viz.ai holds because it exists at the point-of-care (POC). Viz.ai’s customized algorithms detect suspected diseases at the clinic, enabling providers to swiftly take next best actions then and there.

And whereas prescribers may be less inclined to hear from sales reps, they’re potentially more inclined to use AI at the POC, particularly for diagnostics: 72% of respondents in a recent AMA survey considered AI most helpful for diagnostic ability, above all other choices including work efficiency and capacity to see patients.

McKinsey adds that since it could take a while to implement these innovations, biopharma leaders should start planning now. As they do, some manufacturers may need to pick and choose where they deploy AI. Focusing on high-demand areas like under- and misdiagnosed diseases is a good start. Doing so could help expand care access so that patients in specialist-shortage areas have diagnostic opportunities they haven’t historically been able to access.

Where might this AI budget come from? Spending reallocations, McKinsey suggests. As brands adapt to a changing market, they might find that some areas (like field resources) don’t require the budgetary heft they once did. Despite driving a $4B spending cut campaign, for example, Pfizer’s CEO has emphasized its intention to be at the “forefront” of AI use.

Another pivot to consider is the need to redefine “patient centricity.” The scopes of modern patient journeys are fuller, longer, and more complex—and modern commercial planning should account for a wider aperture of stages from access to adherence. Biopharmas will need to audit their market opportunities from the context of specific needs for specific therapeutic areas to identify specific gaps.

Investments in AI-based technologies could help support this renewed idea of patient centricity by streamlining or otherwise consolidating care plans for complex diagnoses—for example, using algorithms to identify lung nodules or other applications to better support frequently undiagnosed, misdiagnosed, or late-diagnosed populations.

With these puzzle pieces in place, brands can start to repave their pathways to commercial success—while implementing other pivots McKinsey recommends: building a sustainable market access and investing in talent and capabilities, for example.

Take the Next Best Action

As seismic changes in competition, pricing, and behaviors affect where, when, and how brands commercialize, it’s up to biopharma leaders to command relevance. Rewriting the age-old model of reps and sales calls may be necessary as manufacturers consider options that serve clinician and patient preferences while narrowing care gaps—like customized algorithms and streamlined care workflows for hypertrophic cardiomyopathy, aneurysm, and more.

If you’re interested in learning how Viz.ai can help your brand in that journey, contact us to get the conversation started.